simple way to evaluate what a company is worth

What's your company worth? Information technology's an important question for whatever entrepreneur, business concern owner, employee, or potential investor — for any size company. Understanding your company'southward value becomes increasingly important every bit the business organisation grows, peculiarly if you want to raise capital, sell a portion of the business, or borrow money. And, like most circuitous mathematical problems, understanding your company's value depends on a variety of factors, similar vertical market and industry functioning, proprietary technology or commodity, and phase of growth. When you add in the impact of technology (every visitor is influenced past technology), it becomes quite circuitous to come to a definitive equation. In this mail service, discover different factors to consider when valuing your business, common equations you tin use, and high-quality tools that will help you practise the math. Company size is a normally used gene when valuing a company. Typically, the larger the business, the college the valuation will be. This is because smaller companies accept piffling market power and are more than negatively impacted by the loss of key leaders. In improver, larger businesses likely take a well-adult product or service and, as a result, more accessible majuscule. Is your company earning a profit? If and so, this a skilful sign, as businesses with higher profit margins will be valued higher than those with low margins or profit loss. The primary strategy for valuing your business based on profitability is through understanding your sales and acquirement data. Valuing a business based on sales and revenue uses your totals earlier subtracting operating expenses and multiplying that number by an manufacture multiple. Your industry multiple is an average of what businesses typically sell for in your industry and then, if your multiple is ii, companies usually sell for 2x their annual sales and revenue. When valuing a company based on market traction and growth rate, your business is compared to your competitors. Investors desire to know how big your industry market share is, how much of it you control, and how quickly you tin capture a percentage of the market place. The quicker y'all attain the market, the higher your business' valuation will be. What sets your product, service, or solution apart from competitors? With this method, the mode you provide value to customers needs to differentiate y'all from the competition. If this competitive advantage is too hard to maintain over time, this could negatively impact your business' valuation. A sustainable competitive advantage helps your business build and maintain an edge over competitors or copycats in the future, pricing you higher than your competitors because you have something unique to offering. Is your market place or industry expected to grow? Or is in that location an opportunity to expand the business' product line in the future? Factors like these will boost the valuation of your business concern. If investors know your business organisation will grow in the time to come, the company valuation will be college. The financial industry is built on trying to accurately define current growth potential and futurity valuation. All the characteristics listed above have to be considered, but the primal to understanding futurity value is determining which factors weigh more heavily than others. Depending on your blazon of business, in that location are dissimilar metrics used to value public and private companies. For public companies, valuation is referred to as market capitalization (which we'll discuss below) — where the value of the company equals the full number of outstanding shares multiplied by the toll of the shares. Public companies tin as well merchandise on book value, which is the total amount of assets minus liabilities on your company balance sheet. The value is based on the asset's original cost less any depreciation, amortization, or impairment costs made against the asset. Individual companies are often harder to value because at that place's less public data, a limited track record of operation, and financial results are either unavailable or might non be audited for accurateness. Let's take a look at the valuations of companies in iii stages of entrepreneurial growth. Startups in the ideation stage are companies with an idea, a concern plan, or a concept of how to gain customers, but they're in the early stages of implementing a process. Without whatever financial results, the valuation is based on either the track tape of the founders or the level of innovation that potential investors run into in the idea. A startup without a financial rails record is valued at an amount that can be negotiated. Nearly startups I've reviewed created by a first-time entrepreneur starting time with a valuation between $1.5 and $6 million. All the value is based on the expectation of future growth. It's not ever in the entrepreneur'due south best interest to maximize its value at this stage if the goal is to take multiple funding rounds. The valuation of early on-stage companies tin can be challenging due to these factors. Adjacent is the proof of concept stage. This is when a company has a handful of employees and bodily operating results. At this phase, the charge per unit of sustainable growth becomes the most crucial factor in valuation. Execution of the business organization procedure is proven, and comparisons are easier because of available financial information. Companies that achieve this phase are either valued based on their acquirement growth rate or the rest of the industry. Boosted factors are comparing peer performance and how well the business is executing in comparison to its plan. Depending on the company and the industry, the company volition trade as a multiple of revenue or EBITDA (earnings before interest, taxed, depreciation, and amortization). The third stage of startup valuation is the proof of the business concern model. This is when a company has proven its concept and begins scaling considering it has a sustainable business model. At this betoken, the company has several years of bodily financial results, one or more products shipping, statistics on how well the products are selling, and product retentiveness numbers. Depending on your company, there are a multifariousness of equations to use to value your business. Let's take a look at some of the formulas for business valuation. Market Value Capitalization is a mensurate of a company'southward value based on stock toll and shares outstanding. Here is the formula you would apply based on your business' specific numbers: You would utilize this method if you're hoping to value your concern based on specific figures similar revenue and sales. Hither is the formula: Discounted Cash Catamenia (DCF) is a valuation technique based on future growth potential. This strategy predicts how much return tin can come from an investment in your company. It is the well-nigh complicated mathematical formula on this listing, as there are many variables required. Here is the formula: Paradigm Source Hither are what the variables mean: This method, along with others on this listing, requires accurate math calculations. To ensure you're on the right runway, information technology may be helpful to utilise a computer tool. Beneath we'll recommend some high-quality options. Below are business valuation calculators you can use to gauge your companies value. This reckoner looks at your business' current earnings and expected futurity earnings to determine a valuation. Other business elements the calculator considers are the levels of chance involved (e.g., business, financial, and manufacture risk) and how marketable the company is. EquityNet'southward business valuation reckoner looks at diverse factors to create an estimate of your business'southward value. These factors include: ExitAdviser's calculator uses the discounted cash catamenia (DCF) method to decide a business'south value. To decide the valuation, "information technology takes the expected future cash flows and 'discounts' them back to the present mean solar day." It may exist helpful to accept an example of company valuation, and so we'll go over one using the market capitalization formula displayed below: Shares Outstanding x Electric current Stock Price = Market Capitalization For this equation, I need to know my business's current stock toll and the number of outstanding shares. Here are some sample numbers: Shares Outstanding: $250,000 Current Stock Price: $11 Here is what my formula would look like when I plug in the numbers: 250,000 x xi Based on my calculations, my visitor'southward market value is 2,750,000. Whether you're looking to borrow money, sell a portion of your company, or simply understand your market value, understanding how much your business is worth is important for your business' growth. To learn more than about entrepreneurship, check out these pocket-sized business organisation ideas next.

How to Value a Business organisation

one. Visitor Size

2. Profitability

Value a Company Based On Sales and Revenue

3. Marketplace Traction and Growth Rate

four. Sustainable Competitive Advantage

5. Future Growth Potential

Public Visitor Valuation

Private Company Valuation

1. Ideation Stage

2. Proof of Concept

three. Proof of Business Model

Company Valuation Equation

Market Capitalization Formula

Multiplier Method Formula

.png?width=2345&name=Blue_Opt01%20(2).png)

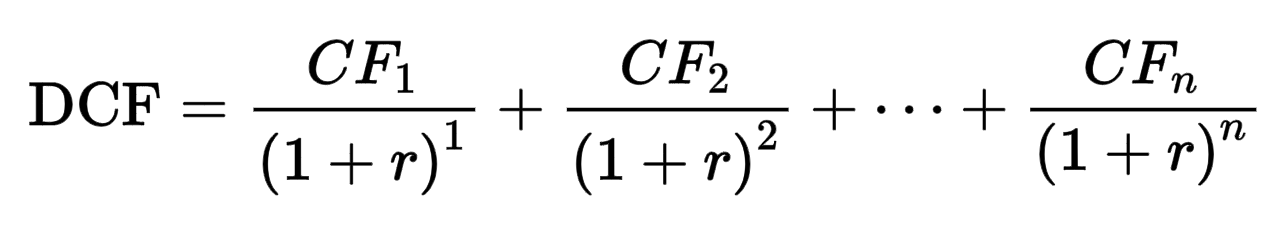

Discounted Greenbacks Catamenia Method

Business concern Valuation Calculators

1. CalcXML

ii. EquityNet

three. ExitAdviser

Visitor Valuation Case

Originally published Jun 30, 2021 4:00:00 PM, updated June thirty 2021

Source: https://blog.hubspot.com/sales/how-to-value-company

0 Response to "simple way to evaluate what a company is worth"

Enviar um comentário